Prediction Markets

Buying and selling a certificate worth a given amount of money if the prediction comes true, but worthless if it doesn't

Putting your

money where

your mouth is!

Buying and selling a certificate worth a given amount of money if the prediction comes true, but worthless if it doesn't

Putting your

money where

your mouth is!

People make

predictions

all the time

predictions

all the time

. . . e.g. about

other peoples'

reactions

other peoples'

reactions

. . . . . . ability to predict

the effect of

your actions on others

is useful

the effect of

your actions on others

is useful

. . . . . . you need a

"theory of mind"

"theory of mind"

. . . . . . you're in a

game theory

scenario

game theory

scenario

. . . . . . data suggests

competition within groups

may be a major cause of

human brain size

competition within groups

may be a major cause of

human brain size

Human brain. Credits: Patrick J. Lynch, medical illustrator; C. Carl Jaffe, MD, cardiologist. Http://creativecommons.org/licenses/by/2.5/

Chimpanzee brain. Credits: Gaetan Lee; tilt corrected by Kaldari. Http://creativecommons.org/licenses/by/2.0/

. . . . . . this is the

social competition theory

of human brain genesis

(ref.: Bailey & Geary,

Hominid Brain Evolution:

Testing Climatic,

Ecological, and Social Competition

Models

Human Nature,

vol. 20, no. 1,

Mar. 2009, pp. 67-79.)

. . . . . . so the need to predict

may explain

why we're human!

(Predict what?)

Prediction is

important in

other areas too

Consider

the weather:

the weather:

Credits:

Don Amaro from

Madeira Islands,

Portugal,

upload by Herrick

17:17, 4 December 2007 (UTC).

Http://creativecommons.org/licenses/by/2.0/

Don Amaro from

Madeira Islands,

Portugal,

upload by Herrick

17:17, 4 December 2007 (UTC).

Http://creativecommons.org/licenses/by/2.0/

Waterspout.

Credits: http://www.photolib.noaa.gov/bigs/wea00308.jpg.

1969 September 10.

Photographer: Dr. Joseph Golden,

NOAA. Public domain.

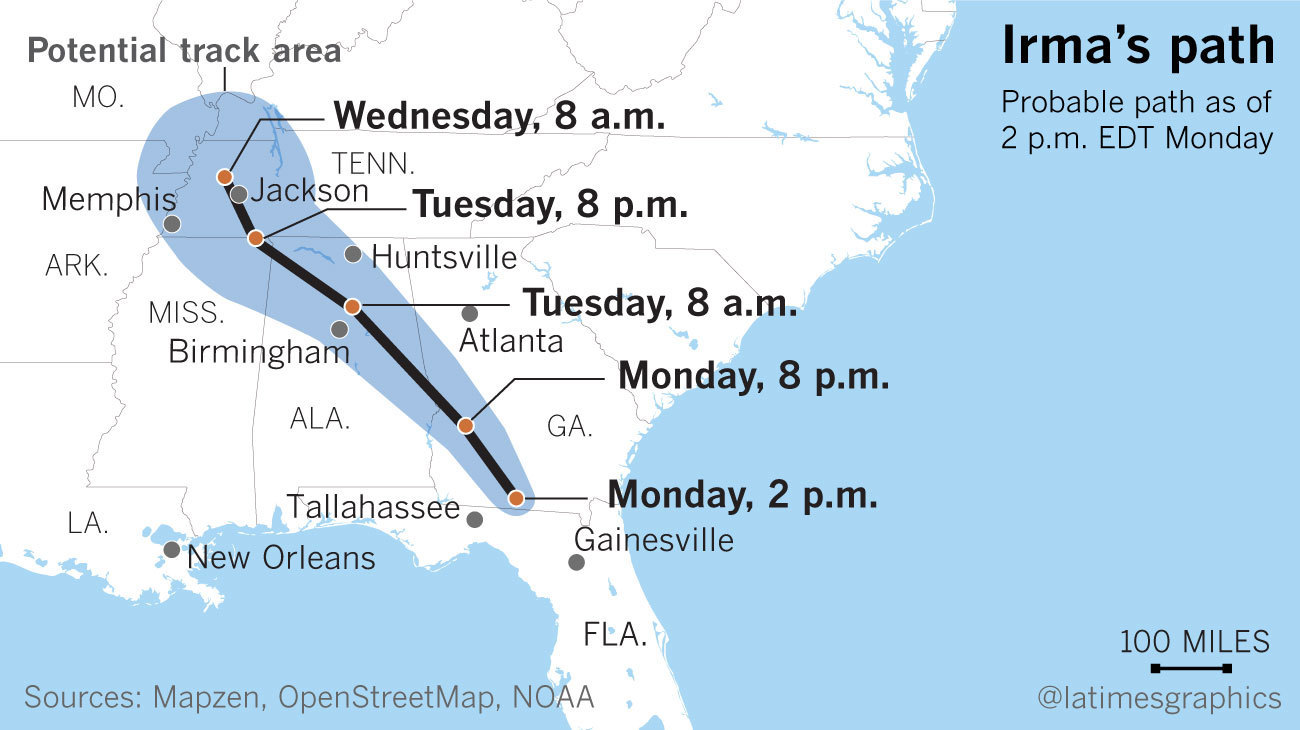

Two images of Hurricane Irma

. . . The National Weather Service (NWS)

is a large, highly technical

gov't agency devoted to

~ prediction ~

using large computers, etc.

Credits: http://www.photolib.noaa.gov/bigs/wea00308.jpg.

1969 September 10.

Photographer: Dr. Joseph Golden,

NOAA. Public domain.

Two images of Hurricane Irma

. . . The National Weather Service (NWS)

is a large, highly technical

gov't agency devoted to

~ prediction ~

using large computers, etc.

. . . It's not perfect

but it's

much better than nothing

but it's

much better than nothing

. . . weather prediction

uses computers

. . . . . . other kinds of

prediction can use

other methods

Crowdsourcing group wisdom...

Horse race betting

is an example

Source: https://www.greatfallstribune.com/story/news/2019/12/09/montana-horse-racing-board-pays-628-k-debt-state-early/2630053001

Bet right, you win $

Bet wrong, you lose $

But if you win, how much $?

It depends on how much was bet on what horse!

A crowd-sourced estimate of the odds

A kind of prediction market

Pari-mutuel betting is typical

Take all $ bet on any horse

Divide it up among bets on the winning horse

From that algorithm you can calculate odds etc.

---

For "place" bets, take all place bets

Divide half among bets on the 1st place horse

Divide other half among bets on the 2nd place horse

---

For "show" bets, take all place bets

Divide 1/3 among bets on the 1st place horse

Divide 1/3 among bets on the 2nd place horse

Divide 1/3 among bets on the 3rd place horse

Other sports betting odds are set ahead of time

Traditionally by bookies in a back room

Experts combining opinions

But not using Delphi method

Would it work better if they used Delphi method?

Prediction Market

Stock market:

Buy if expect it to go up

Were you right? Make $

Were you wrong? Lose $

Stock market is a kind of...

Prediction Market

Other ways of

looking at the

stock market

What are they?

An example from the history of this course

. . . Will the

average global temperature

for 2012

be the highest

ever recorded?

. . . at 12:23 on the afternoon before class (Sp '12):

you could have bought a "yes"

for $2.50 from intrade.com

. . . if you ended up right -

you'd get $10

. . . if wrong -

you'd lose your $2.50

What ultimately happened?

Jan 16, 2013:

NASA: 2012 Was

9th Hottest Year

on Record

As of early 2020:

- "The folly of making political prediction markets like Intrade illegal"

- ... and talk about corporate bad luck ......

Let's go to intrade.com

and check it out

- Some of their prediction graphs are still floating around the web

- E.g. https://www.aei.org/carpe-diem/recession-odds-fall-on-intrade/

- Or search images.google.com for "intrade" and look for graphs

Here are/were some other prediction markets:

- Iowa Electronic Market (IEM) - This prediction market is used for a multitude of predictions including who will be the next president. Universities also use it for research into fields like accounting, finance and economics.

- Electric (more generally, commodities) futures markets

- Predictit.org; polymarket.com

- Inklingmarkets.com; predictit.org

- Augur.net; coindesk.com

- Omen project; good judgment project

- Scicast; predictit.org

- Some from previous years

- fantex.com

- www.ipredict.co.nz

- predictit.org

- www.cultivatelabs.com

- augur.net (also see wikipedia article)

- scicast.org (can link markets, an advanced capability)

- www.predictious.com

- Åzone Futures Market

- Various sports betting companies

- Online sports betting is getting more legal in the US

Ok, here's another problem

with prediction markets

People might bet

for other reasons

than to make $

Why might someone do that?

Bet on something you don't want to happen

- If it happens anyway, you'll feel better!

Hedge a financial loss by betting it will happen

- Stock market might decline

- So, buy a bet that it will!

- Purely personal issues would not work

- Why not?

Manipulate odds to affect reality

Can you think of

a possible example?

Example:

Manipulate press coverage

of a presidential election

It's been done!

It's expensive!

Why do it?

Why should Intrade

prediction contracts

get closer to

$10 or $0,

PredictIt contracts

get closer to $1 or $0,

LR Prediction Company* contracts

get closer to $100 or $0,

etc.,

as they approach

resolution?

*???

Could price ever get

high, then end up low

(or vice versa)?

We started calling them "bets" ...

But technically it's a "prediction market contract"

- It's still a bet!

5. More about sports prediction markets

Tim Henman

serving at Wimbledon, 2005.

Credits: Photo by Spiralz, license by http://creativecommons.org/licenses/by/2.0/

. . . Sports betting has

a long history

. . . People want to

predict games

They'll pay

good money

to do it!

. . . A theoretically ideal

"honest bookmaker"

will not expect to make a profit

predict games

They'll pay

good money

to do it!

. . . A theoretically ideal

"honest bookmaker"

will not expect to make a profit

. . . . . The $$ bet are

merely redistributed

merely redistributed

. . . (But how do

real bookmakers

differ from that?)

. . . . . This is how horse racing works

6. Political prediction...

real bookmakers

differ from that?)

. . . . . This is how horse racing works

6. Political prediction...

. . .During election season,

media and candidates

all try to

predict outcomes

media and candidates

all try to

predict outcomes

. . . Some of it

you don't hear about

you don't hear about

. . . polling,

trend analysis,

sociological analysis

are big

. . . but why is

asking people

their opinion

unreliable?

trend analysis,

sociological analysis

are big

. . . but why is

asking people

their opinion

unreliable?

. . . predictions markets

have been claimed

to do it better!

. . . But they aren't perfect

have been claimed

to do it better!

. . . But they aren't perfect

- Manipulation can skew results

- People can buy predictions "irrationally"

- Example: 2012 election

7. About corporate stocks...

. . . . . . The stock market

is a

"leading economic indicator"

is a

"leading economic indicator"

. . . . . . (Economists pay

special attention to

leading indicators)

. . . . . . Is the stock market

a prediction market?

special attention to

leading indicators)

. . . . . . Is the stock market

a prediction market?

8. If someone

asked you

to invent a way

to collect

group predictive wisdom,

what might you come up with?

asked you

to invent a way

to collect

group predictive wisdom,

what might you come up with?

. . . Maybe a

Delphi-like method

Delphi-like method

. . . Probably (?) not

prediction markets

. . . . . .However, by accident,

horse racing is in that direction

prediction markets

. . . . . .However, by accident,

horse racing is in that direction

. . . . . . An early design for

prediction markets

appears in

The Shockwave Rider,

by John Brunner, 1975

prediction markets

appears in

The Shockwave Rider,

by John Brunner, 1975

. . . . . . General idea:

when real money

is at stake,

people predict better

Do you agree?

when real money

is at stake,

people predict better

Do you agree?

9. Terrorism and

prediction markets

. . . . . . DARPA's PAM

(Policy Analysis Market)

permitted a

prediction market

for terrorist attacks

(Policy Analysis Market)

permitted a

prediction market

for terrorist attacks

. . . . . . It worked like this:

How much would you pay

to get $100 if there is a

snowstorm tomorrow?

Trick 1: buy a snowstorm prediction cheap

Make a snowstorm happen, then collect $100

Similarly for a terrorist attack

Trick 2: watch for terrorism contracts

Arrest them first

. . . . . . Does that

sound like

a good idea

to you?

. . . . . . How might it

help fight terrorism?

+ we might have forwarning

- terrorists might

buy predictions, then

make them come true

to make $$$!

buy predictions, then

make them come true

to make $$$!

. . . . . . In 2003,

2 senators found out,

PAM was cancelled, and

a DARPA

program director resigned

2 senators found out,

PAM was cancelled, and

a DARPA

program director resigned

. . . . . . . . . not clear if

terrorism predictions

were ever traded

terrorism predictions

were ever traded

10. As time allows,

let's

- try our own prediction market!

Prediction market contract:

see syllabus

About how to do it, as well as some of the finer points:

let's

- try our own prediction market!

Prediction market contract:

see syllabus

About how to do it, as well as some of the finer points:

The rational participant would be willing to buy a contract for a little less than the probability of the event occurring (and thus paying off), and sell for a little more than that probability. For example if the event was a six resulting from a roll of a fair die, it would be worth buying a contract for that for $16 and selling one for $17 for a contract worth $100 (since the probability of the event is 16.67%).

To create new contracts, it works for the broker to simply lend out blank contracts for free; if the event later occurs the person taking one would have to then pay the broker $100, and if the event does not occur the contract is worthless and the broker is not paid anything.

It is an interesting point that the originator has a different risk

exposure. So they would demand a risk premium, suggesting that the

price should decline a bit over time, not because of any changes in

probabilities in the domain of the contract, but just as an artifact

of the origination risk. As the broker and proprietor of the "Little

Rock Prediction Market Co." I get to make the rules and I made them to

be useful in an in-class simulated prediction market. In a normal

semester we would be buying and selling them every week until the end

of the semester (or the event the contracts are about occurs,

whichever happens first). Then at the end of the semester I'd show a

graph of the price over time, and send everyone an email explaining

how much money they won or lost.

I could of course make bad rules, and in that case the rational

market player would play to win, leading to prices that do not reflect

the underlying probabilities.

A similar origination problem might occur with real prediction

markets - somehow the market must be primed with new contracts, and

how are they to be priced? If there are lots and lots of buyers

compared to the number of contracts, the contracts could just be sold

to the highest bidders. I can't do that in class because there aren't

enough students and also because it would be confusing to many people.

Another problem like this occurs with stock IPOs - the initial price

is just a guess (I think? Or maybe it is manipulated to be too low so

that the first purchasers have a better chance of cleaning up?) and

the price can then swing wildly at first, exposing early buyers to

increased risk. Another situation like that is when a prediction

market reaches its end. If it rapidly becomes clear what the outcome

is, the people still holding the contracts won't be able to buy and

sell them fast enough to track the events on the ground, exposing them

to the same kind of increased risk. In an extreme case, suppose the

contracts were about the outcome of a roll of the dice. The outcome

goes from pure chance to completely settled in an instant, exposing

late buyers to increased risk.

Another aspect to the market as designed for this course is it

accommodates uncertainty about the probability. For example, you might

not be confident of your estimate of 20% probability, but more

comfortable guessing that it is somewhere between 20% and 50%. Then

you would be willing to buy for $19 and sell for $51. If you were more

risk-tolerant, you might reason that the real probability is more

likely to be somewhere in the middle region than very near 20% or 50%,

so you might then be willing to buy for $25 and sell for $45, if

needed in order to execute a transaction.

Disclaimer:

Using gen-u-ine, real $10 bills would make this a very memorable learning experience. Thus, it would have educational benefit! Nevertheless, we will only pretend, because this course wishes to avoid a legal minefield of potential complications.

exposure. So they would demand a risk premium, suggesting that the

price should decline a bit over time, not because of any changes in

probabilities in the domain of the contract, but just as an artifact

of the origination risk. As the broker and proprietor of the "Little

Rock Prediction Market Co." I get to make the rules and I made them to

be useful in an in-class simulated prediction market. In a normal

semester we would be buying and selling them every week until the end

of the semester (or the event the contracts are about occurs,

whichever happens first). Then at the end of the semester I'd show a

graph of the price over time, and send everyone an email explaining

how much money they won or lost.

I could of course make bad rules, and in that case the rational

market player would play to win, leading to prices that do not reflect

the underlying probabilities.

A similar origination problem might occur with real prediction

markets - somehow the market must be primed with new contracts, and

how are they to be priced? If there are lots and lots of buyers

compared to the number of contracts, the contracts could just be sold

to the highest bidders. I can't do that in class because there aren't

enough students and also because it would be confusing to many people.

Another problem like this occurs with stock IPOs - the initial price

is just a guess (I think? Or maybe it is manipulated to be too low so

that the first purchasers have a better chance of cleaning up?) and

the price can then swing wildly at first, exposing early buyers to

increased risk. Another situation like that is when a prediction

market reaches its end. If it rapidly becomes clear what the outcome

is, the people still holding the contracts won't be able to buy and

sell them fast enough to track the events on the ground, exposing them

to the same kind of increased risk. In an extreme case, suppose the

contracts were about the outcome of a roll of the dice. The outcome

goes from pure chance to completely settled in an instant, exposing

late buyers to increased risk.

Another aspect to the market as designed for this course is it

accommodates uncertainty about the probability. For example, you might

not be confident of your estimate of 20% probability, but more

comfortable guessing that it is somewhere between 20% and 50%. Then

you would be willing to buy for $19 and sell for $51. If you were more

risk-tolerant, you might reason that the real probability is more

likely to be somewhere in the middle region than very near 20% or 50%,

so you might then be willing to buy for $25 and sell for $45, if

needed in order to execute a transaction.

Disclaimer:

Using gen-u-ine, real $10 bills would make this a very memorable learning experience. Thus, it would have educational benefit! Nevertheless, we will only pretend, because this course wishes to avoid a legal minefield of potential complications.

No comments:

Post a Comment